Thoughts on the SVB 2023 DTC Wine Survey

The Silicon Valley Bank Direct-to-Consumer report came out recently. It outlined three catalysts for marketing changes:

- Changing Demographics: The shift from baby boomers to younger consumers as dominant wine buyers affects demand patterns.

- Market Dynamics: Decreasing grape and bulk wine prices in some regions, encouraging innovation and new products aimed at younger consumers.

- Direct Sales Growth: An increase in DTC sales, with a decline in revenue from traditional tasting room visits as new sales channels emerge.

For this blog post, I reviewed the report, selected some of my favorite charts, and added some commentary.

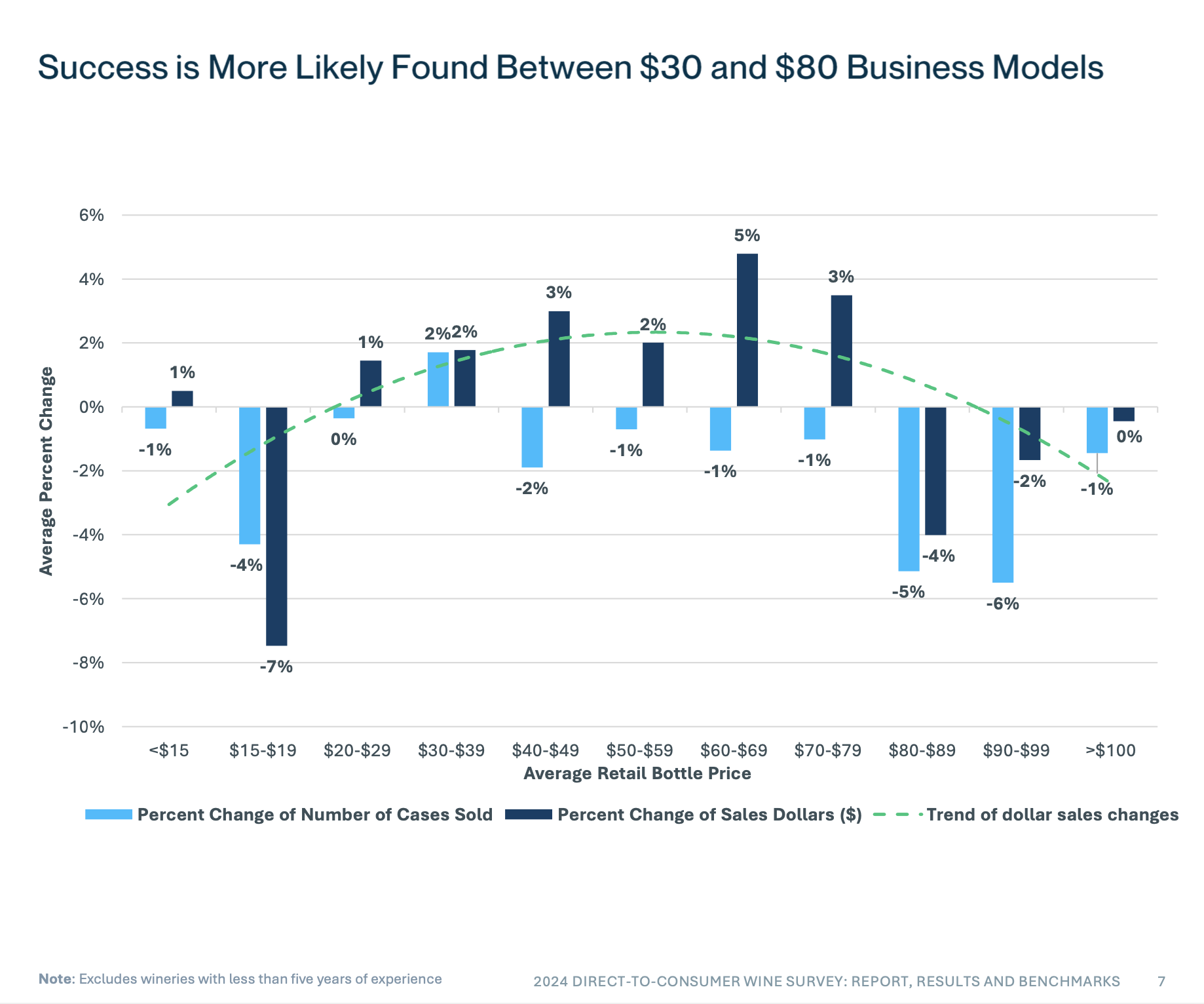

“Wineries selling between $30 and $80 report increasing sales dollars in this year’s survey.”

This is backed by WGM and Wine Market Council research that shows that millennials between 27 and 42 in both prime earning and consumption years are more likely to purchase a bottle of wine over $40 than other groups. Also, we’re seeing that Baby Boomers, who were always the most cost-conscious and loved their Club discounts, are reducing consumption and on a fixed budget in retirement. This also aligns with other luxury industries outside the wine industry, like fashion. For those of you who still think Millennials are young, poor and don’t spend money on luxury goods, update your thinking or be left behind.

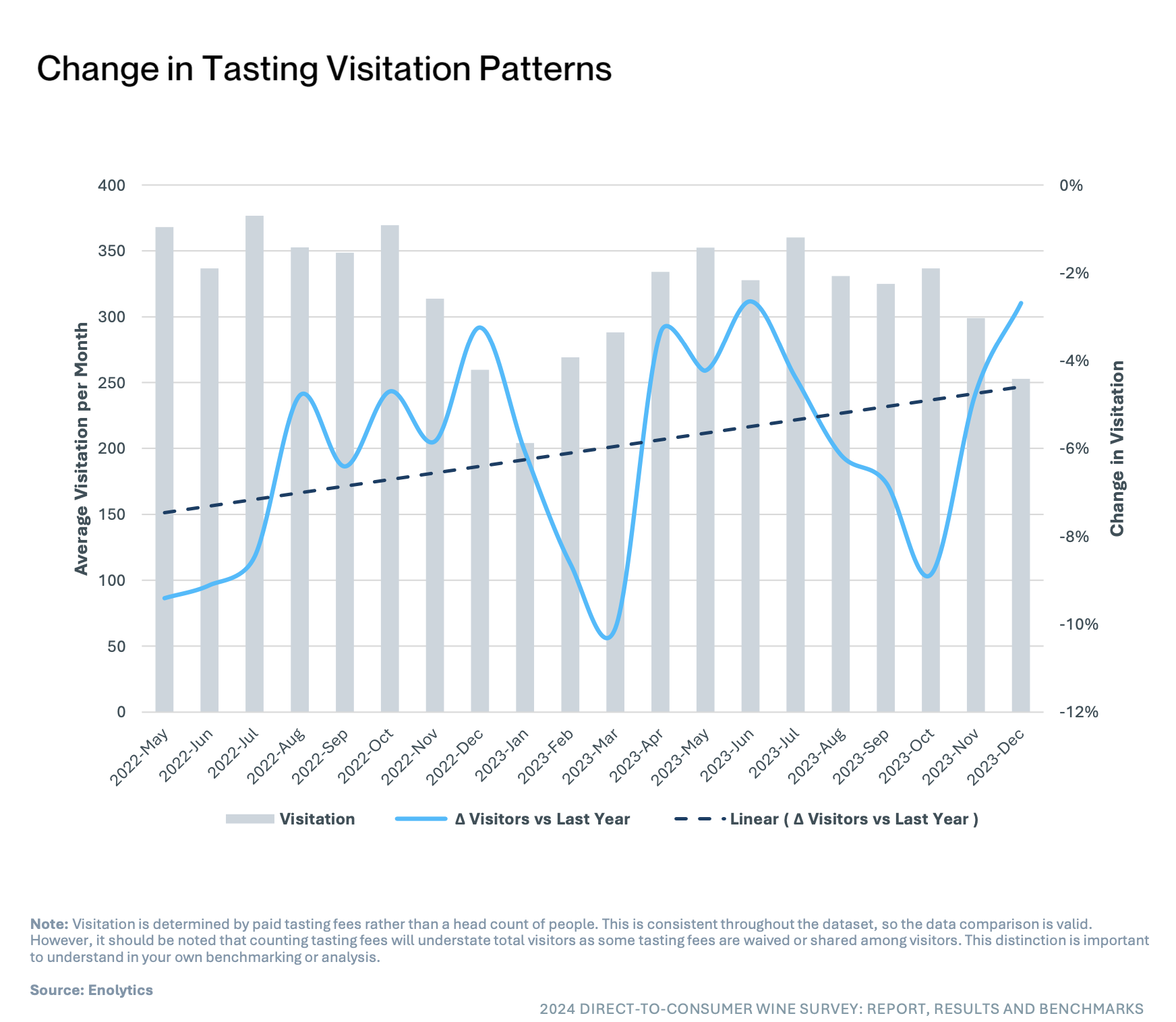

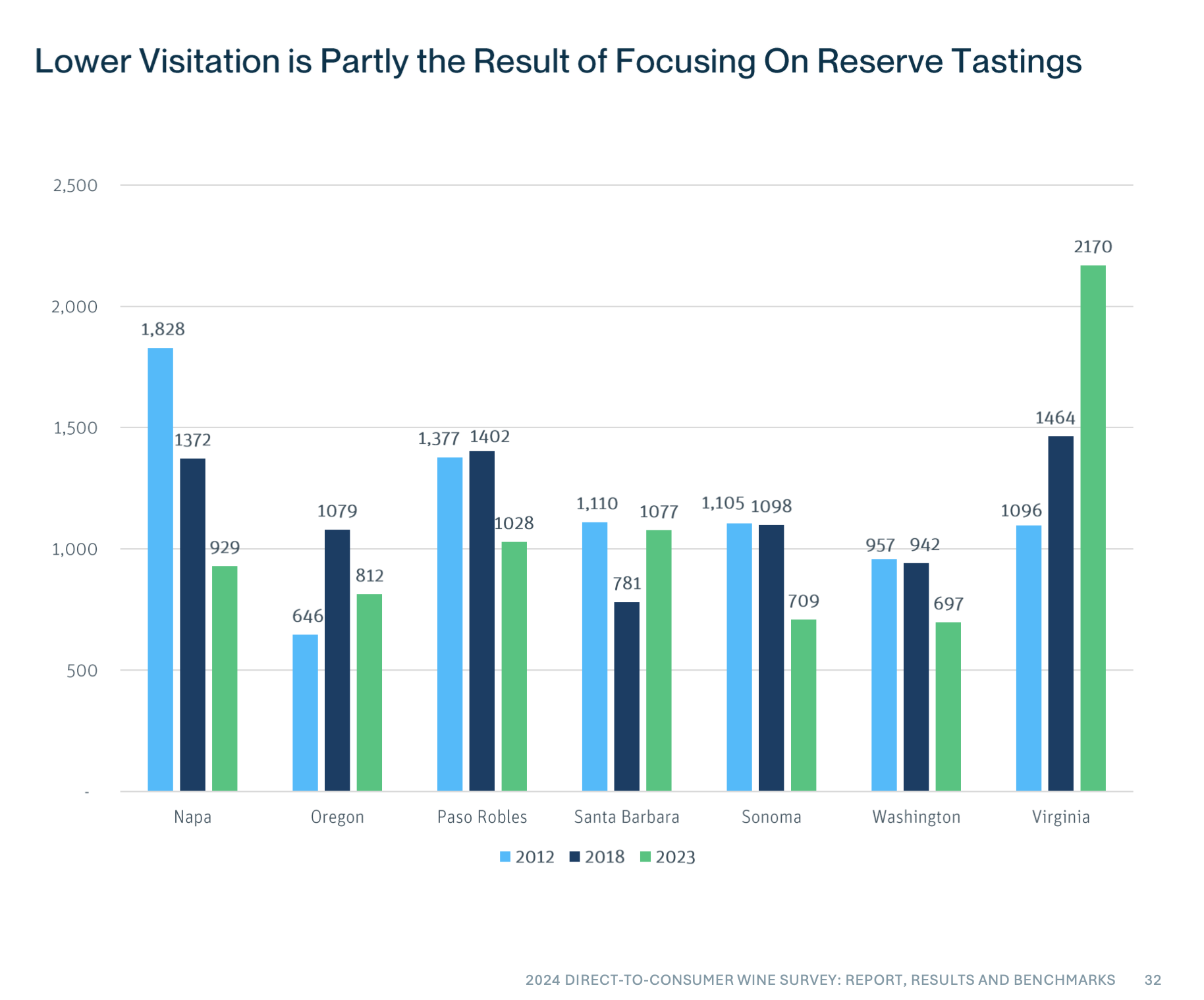

“I believe the signs now point to an end of the revenge travel phase of COVID recovery, and we may see the return of more predictable visitation patterns.”

This observation doesn’t consider the changing consumer dynamics and the increasing reliance on the internet for commerce. Since a young age, these consumers have grown up with an insider view of other cultures, creating a stronger interest in travel abroad than previous generations. Millennials and Gen Z have similar travel preferences, including wanting to experience new cultures, try modern activities, and visit far-off locations. They also value authenticity and will likely choose destinations that align with their interests. Gen Z, in particular, may prioritize and seek out tourism options adhering to social and environmental standards. Couple that with the comfort of buying high-end items online without in-person research, and we have a problem. In short, tourism can rebound, but only if we start tailoring experiences to this group (which many wineries are doing.)

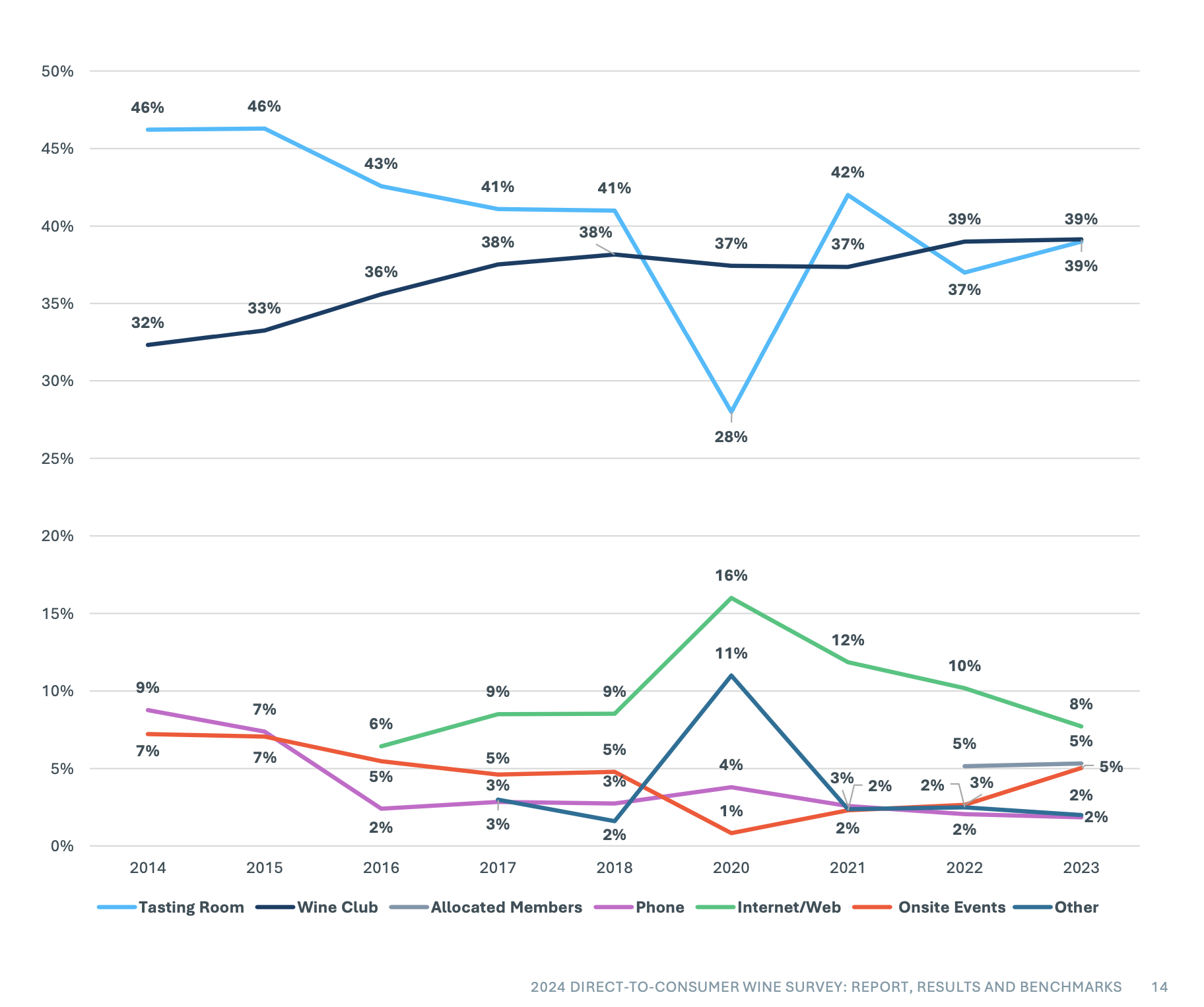

“As the industry growth rate slows, it’s disheartening to see that a promising channel like e-commerce is not getting the attention it deserves.”

Can I get an “amen”? We did so well during COVID-19 – we advanced our marketing ten years overnight. But sadly, when tasting rooms opened, I had a front-row seat to every client, pulling all their marketing dollars back to drive traffic to the tasting room. Fast forward to now, as traffic to the tasting room slows, instead of building up other channels, I see wineries again cutting budgets and throwing everything they have into events and traffic drivers. I know it is easy to armchair quarterback and tasting rooms cost a lot and need oxygen, but don’t overlook the opportunity for e-commerce sales. Remember, Millennials are twice as likely to buy something online than previous generations and are comfortable enough to make expensive purchases without trial. Both of these facts are in our favor. For wineries willing to invest in a quarter of learning and tweaking, we’re seeing a Return On Ad Spend close to 3x for our clients selling wine $100+ per bottle via ads on Google and Meta.

“If the economy continues its current trajectory and there are no major negative news-dominating surprises, total 2024 DTC sales should end the year at least on par with 2023 value sales.in wine country, this

summer.”

I am concerned about Q4 2024. The politics in the US could overshadow social media, email boxes, and text messaging to the extent that consumers go numb. This will be a chaotic holiday season with many messages competing for attention. The safe bet is to project we will be down from previous years.

“I believe every winery owner should rethink their fixed tasting room fee structure and develop a marketing strategy around variable fee structures. For instance, examine periods when the tasting room isn’t full. If it’s 3:00 p.m. on Tuesday, create an experience for entry-level consumers by offering tastings of entry-level wine that includes live music curated for your targeted consumer. There are endless possibilities.”

I love the idea of bifurcating your offerings to cover different groups (as long as the assumption isn’t that newer consumers want to be educated on wine like previous consumers did because they don’t.) I have been inspired by the creativity of changes wineries are making to add non-alcoholic options and multi-generational activities, which are both huge trends right now.

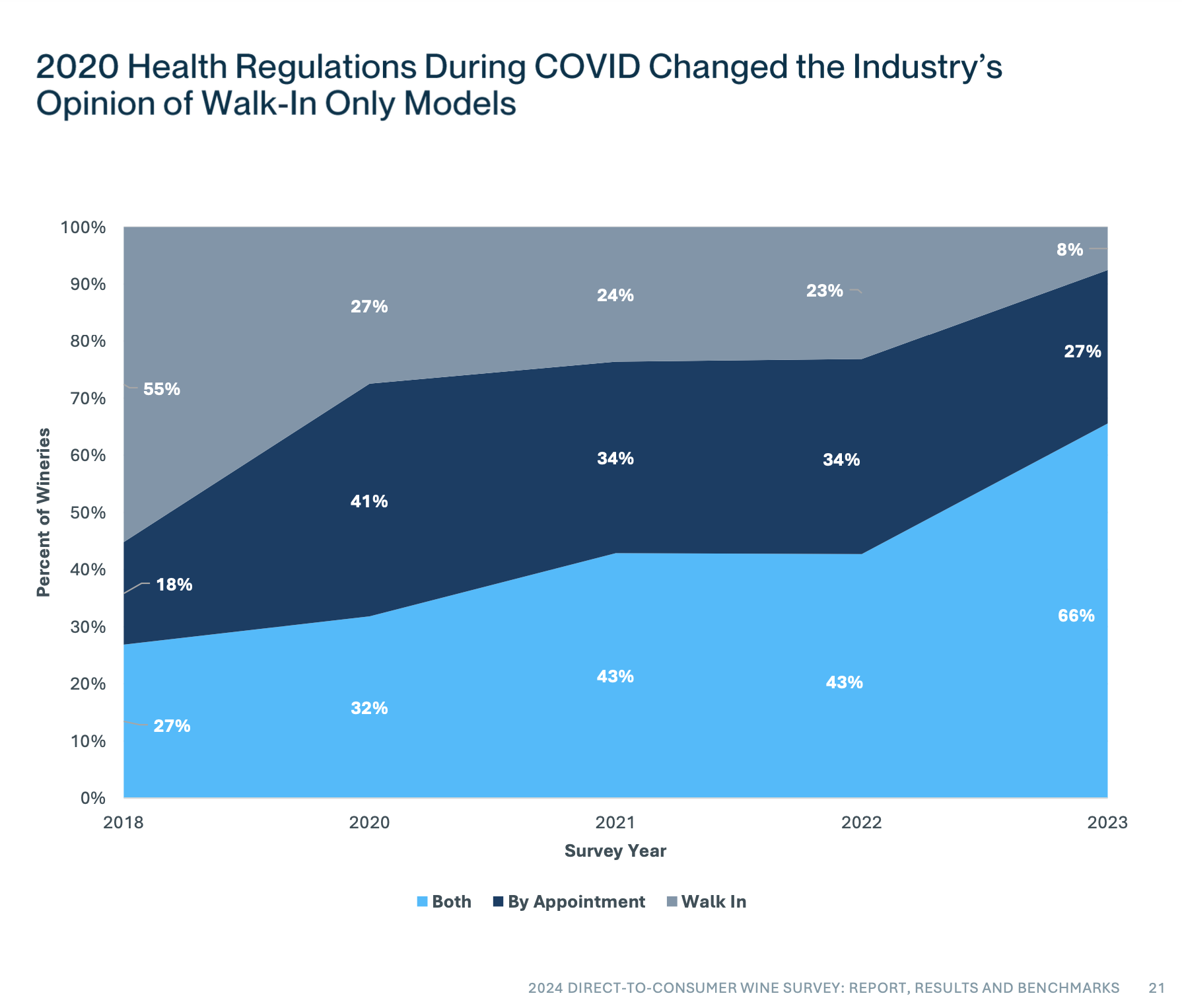

“The more recent debate is walk-in versus by-appointment, with the latter moving into a final phase of adaptation. We’ve been proponents of the by-appointment model, and gradually, the industry has moved in that direction. COVID was the final nail that made walk-in bars a poor use of space.”

In my travels and conversations with wineries and consumers, I’ve been getting whiffs of a backlash against expensive and elaborate guided tastings in favor of more casual experiences for Millennials. The tasting bar could enjoy a renaissance. The best business plan is to offer both or at least a variety of reserved experiences to attract different types of people. This sentiment explains the decrease in tastings in areas that fully embrace more structures and elaborate experiences.

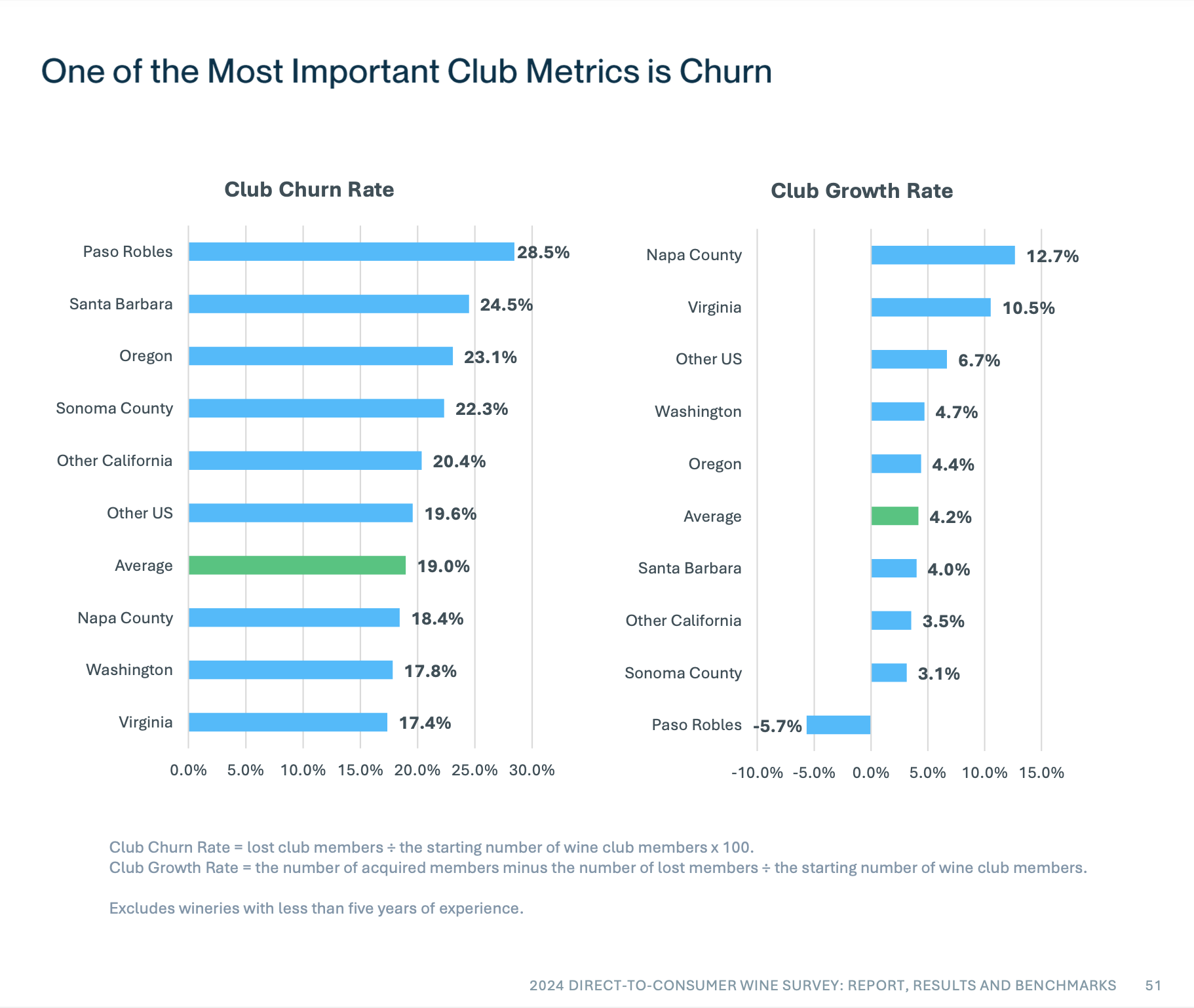

“While it’s encouraging that most regions’ wineries are adding new club members at a rapid pace, the high rate of churn is a pressing concern that needs continuing ideation.”

Churn is the problem: It’s expensive to tread water, as Boomers realize they have too much wine, and Millennials aren’t behaving as collectors. Unfortunately, this consumer shift won’t change anytime soon, and until we get a recurring sales model that appeals to Millennials, we’ll be living in a churn reality. The challenge is to understand why someone is buying a club. In the case of Boomers, it was for a discount and loyal support of a brand they had vetted. In the case of Millennials, it’s for convenience and trial. So, the more we can make our wine clubs all about variety and easy shipping, the better our outlook is for routine sales.

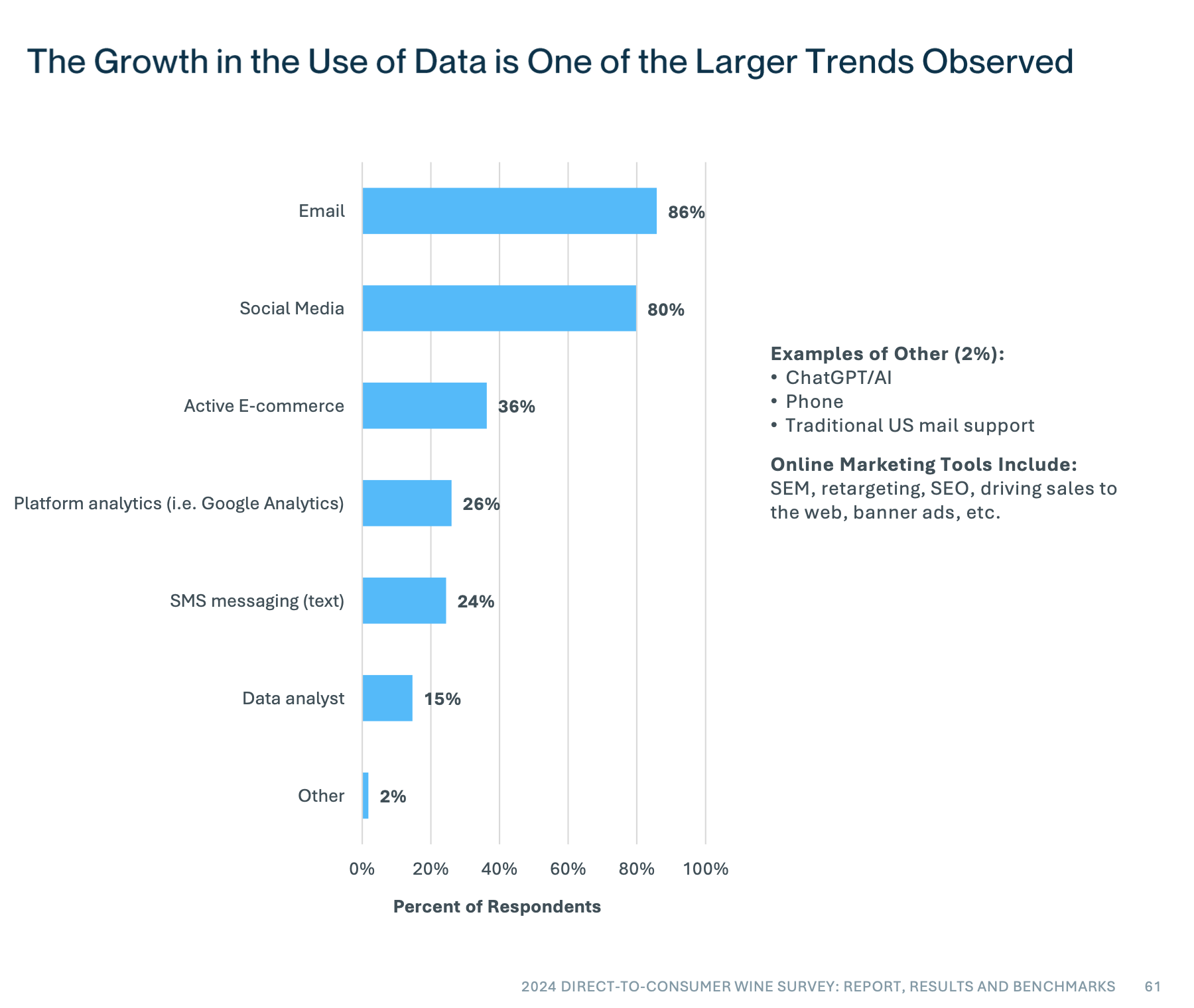

“Email revolutionized digital selling first, followed by social media. Digital analytics and active e- commerce have been the latest technology adopted. The decade ahead will likely see the increased use of new data management tools. AI and machine learning may also impact the future of DTC, playing an increasingly important role in consumer research and strategic decision-making.”

Email is still the best ROI for reaching your customers, so it’s no surprise it is the most frequently used tool. The report expands on similar trends of growing databases and increased attention to cleaning and maintaining those databases, which is necessary for accurate projections. With new and affordable tools available for database mining, this area will only increase in interest. The way out of our current predicament may not be more acquisition of customers, but instead, we should look inward to cultivate the relationships we’ve already started.

In a couple of weeks, we’ll release our 2023/24 email benchmarks with more trend data for those of you who want to go further down the rabbit hole with me. (You know you want to…sign up to get it emailed to you here>>)

All the data in the SVB report echo what we’ve been seeing and reading in other studies. We are in a pivotal year with many of our old standards being challenged. Seeing what will develop next as we explore new opportunities is exciting.

For more on the 2023 Silicon Valley Bank DTC Survey, please download the full results here.>>