When a refund order is placed in your eCommerce system, it comes into Quickbooks through our integration as a Credit Memo.

Once Credit Memos being to be added to your orders in Quickbooks the value of the Credit Memo subtracts from the total value of the customer. Once a Credit Memo exists in the system you need to mark it as refunded.

You have to actually refund the credit memo to the credit card (or cash). This is one of the few manual things needing to be done with WGits for QB. To do this, go to the Customer Center, and then go to the customer you are importing your sales to. If you have not refunded the credit memos, then you should see a negative balance for that customer. Run an open balance report and then open each credit memo.

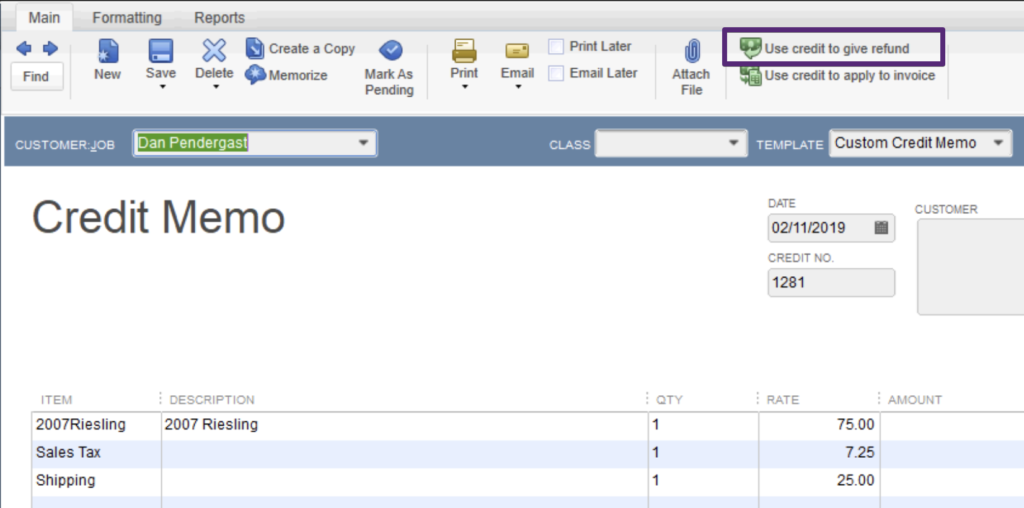

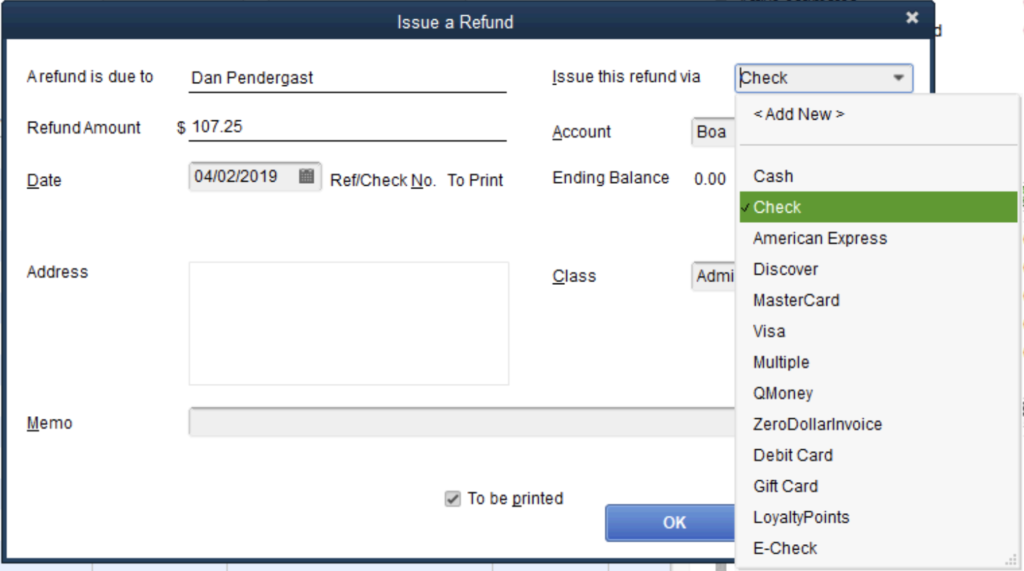

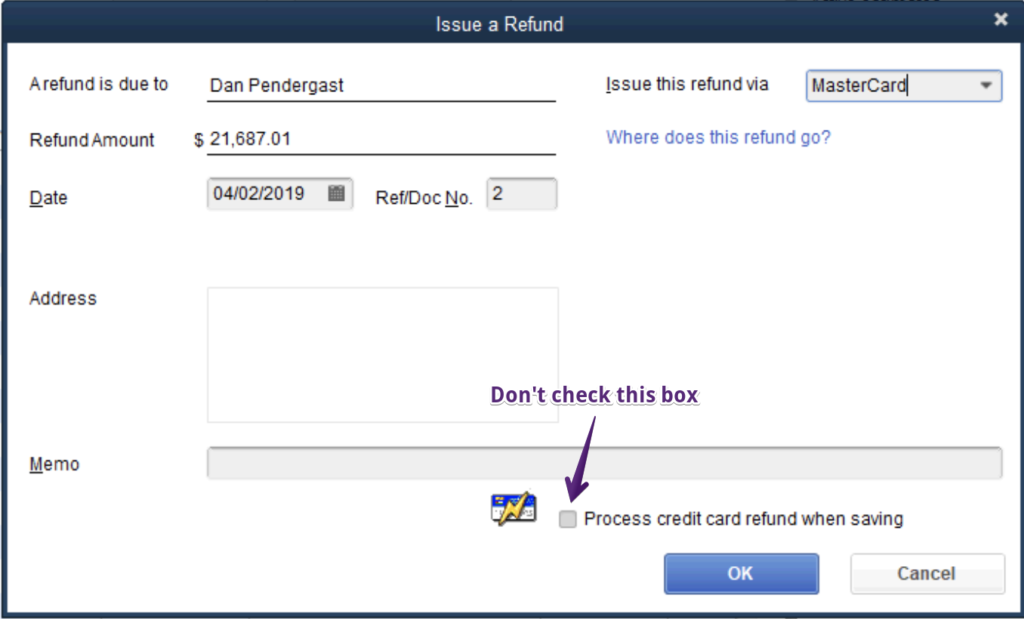

At the top right of the credit memo screen, you should see a Use Credit to Give Refund option. Click on that, and then you can look in WineDirect to see which card the refund should go to. You can usually put in the date the refund occurred and use the same refund number that your ecommerce system has. Be sure the checkbox at the bottom of the screen “To be printed” or “Process Credit card refund when saving” is not checked, and be sure the refund is in Undeposited Funds. It’s also a good idea to change the Ref/Doc number to match the Credit Memo number in your system to ensure the Make Deposits section is easier to reference.

Make sure the Date matches the date of the Credit Memo and the Ref/Doc Number matches the Credit Memo Number.

This should help your deposits batch properly when you go to Banking > Make Deposits.

Note: At times the credits end up in weird places in that window for making deposits due to how Quickbooks interprets the data, but this should ensure that your process flows as smoothly as possible.