When someone buys a Gift Card that will appear as a sale which collects revenue in QuickBooks and will appear as a sold line item on the sale.

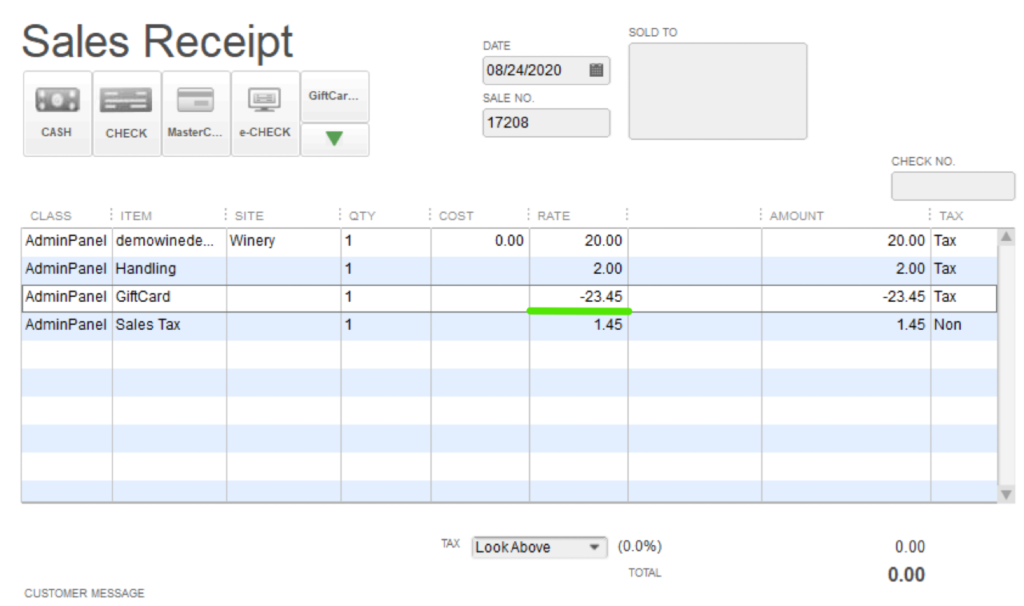

When someone redeems a Gift Card, the value used on the Gift Card will appear as a line item on the order and will subtract from the total of the sale.

If the value of a Gift Card is enough to cover the entire sale of an order, that order will appear with a revenue of $0.00 thanks to the subtraction of the value of the Gift Card.

Gift Card Setup

Sell Gift Card. It’s recorded as revenue and recorded as an item sold which adds to the GC Liability account.

Use Gift Card, it should be subtracted from the Sales Receipt and Deducted from the GC Liability account.

When the gift card is used, it deducts from the liability account that the purchase was sent to originally and credit the sales receipt so the sales receipt is the proper amount.

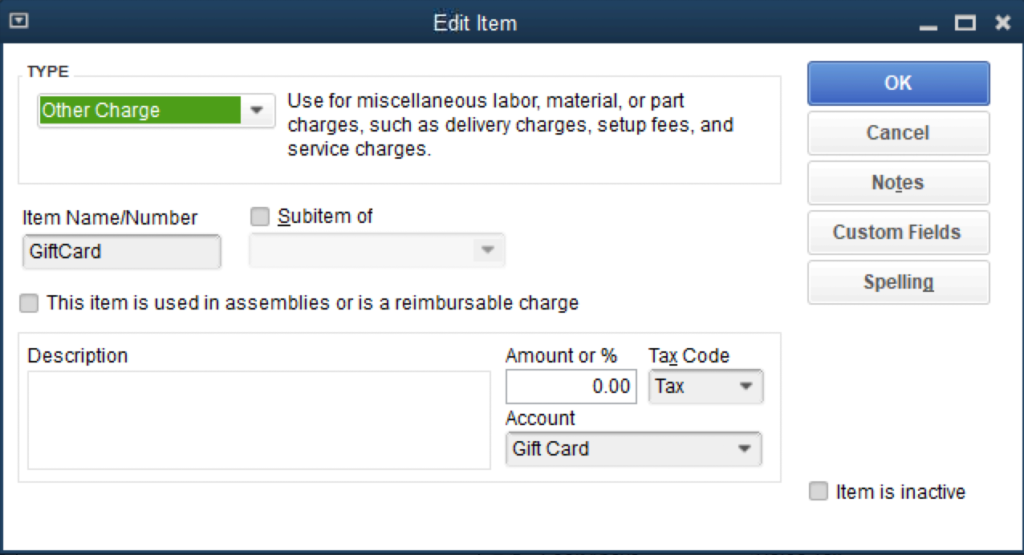

This product is set up like this in our example (it can be a service or an Other Charge type):

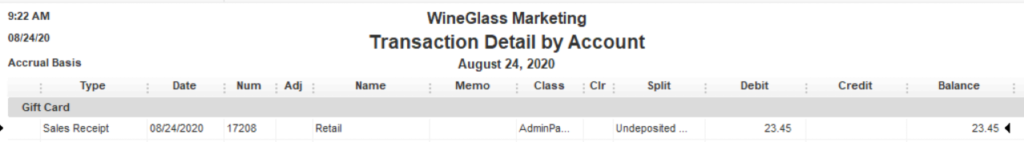

Then when we see the $ amount applied to this account it comes over as a debit rather than a credit (see the report example below):